Federal Deposit Insurance

You can also use the FDIC’s estimator for hypothetical situations. Before you begin trying to communicate with prospective clients, however, you need to make sure your branding is clear. As of January 1, 2013, all of a depositor’s accounts at an insured depository institution, including all noninterest bearing transaction accounts will be insured by the FDIC up to the standard maximum deposit insurance amount $250,000 for each deposit insurance ownership category. They molded their strategies, adapted to the environment of prospecting, and evolved with the technology. Learn more about the measures we take to safeguard your assets Financial Success Collaborative (formerly «B.E.S.T. Alliance») at Schwab. Depository financial institutions institutions that accept consumer deposits in Georgia including banks, credit unions, and thrifts/savings banks have deposit insurance through the FDIC or the NCUA. Start by asking to connect with people who are already connected with your clients and colleagues. The hardest part of using social media is discovering what gains traction and brings in an audience. The issue has taken on renewed importance with the emergence of financial technologies – such as crypto assets, including stablecoins – and the risks posed to consumers if they are lured to these or other financial products or services through misrepresentations or false advertising. Financial advisors regularly assess your financial situation and get back to you with positive and negative reviews to warn you about upcoming losses and ways to stop it.

FDIC Insurance Deposit Coverage

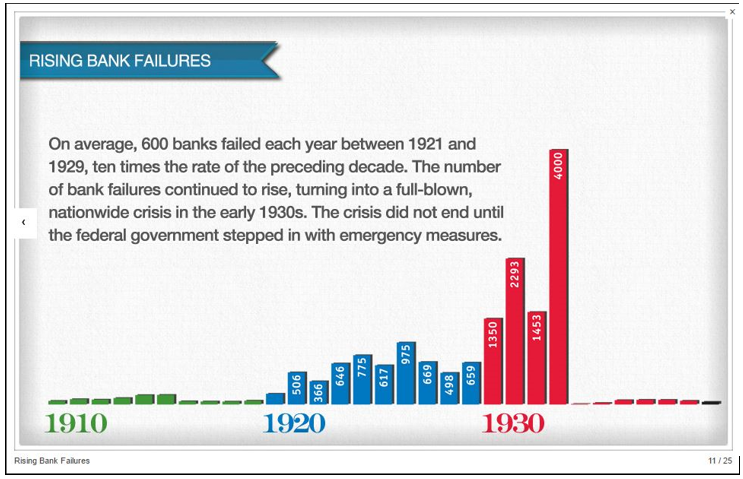

At Roosevelt’s immediate right and left were Senator Carter Glass of Virginia and Representative Henry Steagall of Alabama, two of the most prominent figures in the bill’s development. The most common form of deposit insurance is administered by the FDIC. Beginning January 1, 2013, funds deposited in a non interest bearing transaction account will no longer receive unlimited deposit insurance coverage by the Federal Deposit Insurance Corporation FDIC. Privacy Terms of Use Sitemap. I don’t have anyone sending me leads as they did in my former firm. My goal is to answer the following question: how does a financial advisor create LinkedIn messages and sequences that generate leads for his or her firm. Currently, the FDIC insures deposits at FDIC insured banks and savings associations up to $250,000 per depositor, per FDIC insured bank, for each account ownership category. We use cookies to ensure we give you the best possible browsing experience. This depends on your field of business and in this case, it’s financial advising. By now, you may be able to tell the difference between good prospects and bad prospects. Click here to read our Terms of Use. Should a bank fail, the FDIC will ensure that deposits are returned and creditors get what can be salvaged from the bank’s assets. You can learn more about the process here. An independent agency of the federal government, the FDIC was created in 1933 in response to the thousands of bank failures that occurred in the 1920s and early 1930s.

Popular Posts

The focus shifted away from face to face communications and toward online interactions as social distancing became the norm. Referrals are one of the best financial advisor prospecting ideas that you should always consider. For more information about FDIC insured products available through Schwab’s Affiliated Banks or your Schwab brokerage account, contact us. Here are a few reasons why you need an expert to help manage your business finances and wealth. For those of you who are new to my blog/podcast, my name is Sara. The financial advisor can help you save money and time you can earn more, which means that the money you have spent is worth it, and you can expect a quick return on investment. Textual Records: Lists of national banks, 1941. Since the FDIC was established in 1933, no depositor has lost a penny of FDIC insured funds. By getting to know your target audience, you can build trust and grow your business. When you join these groups, you’ll find yourself having organic conversations with people from all walks of life—many of whom will either need your services at some point or know someone else who does. There are a variety of financial advisor prospecting ideas you can effectively use. For instance, in the early 1980’s the Bank of the Commonwealth received open bank assistance because it was providing banking services to minorities in Detroit. Use the following links to open a new window to the Online Banking login page. Checking accounts, savings accounts, CDs, and money market accounts are generally 100% covered by the FDIC. Despite the all too common feeling that you’re ‘narrowing the playing field’ by choosing a niche you aren’t. View the most recent official publication. Our editors will review what you’ve submitted and determine whether to revise the article. For more information. Read our SIPC information to see how we protect your Schwab brokerage account. Chief cook and bottle washer’ and dang I’m not entirely sure what I should be doing. Social media is a perfect platform for connecting with people in your niche market. This document is available in the following developer friendly formats. Switchboard: +32 2 490 3000. The Federal Deposit Insurance Corporation FDIC is an independent federal agency insuring deposits in U. Podcasting is a new way of letting your audience experience your content differently. Most deposits at national banks and FSAs are insured by the FDIC.

Resource Center

The mission of Independent is to boldly advance peaceful, prosperous, and free societies grounded in a commitment to human worth and dignity. Knockout Networking for Financial Advisors covers everything you need to know about going to the right places virtual or not. For banks, the FDIC can require certain capital, investment, and oversight requirements that reduce chances of bank failures in exchange for insuring the deposits at a bank. Congress created the FDIC in 1933 during the Great Depression in response to widespread bank failures and massive losses to bank customers. Log in through your institution. Proven financial analysts have good career opportunities and can progress to become business analysts, finance managers or commercial managers. You should contact your legal, tax and/or financial advisors to help answer questions about your specific situation or needs prior to taking any action based upon this information. After obtaining a Master’s degree in the Netherlands, non EEA students can apply for a residence permit under the Orientation Year for Highly Educated Persons’ scheme. Records of the Banking and Business Section, 1934 65, includingreference materials of Clark Warburton, a division economist andlater chief of the section, and historical studies and reports. The results of this work are published as books, our quarterly journal, The Independent Review, and other publications and form the basis for numerous conference and media programs. Please review the Credit Card Application Disclosure for more details on each type of card. Try these 7 financial advisor prospecting ideas now. Sign On to Mobile Banking. In this blog post, we walk through 5 financial advisor prospecting methods that we are doubling down on, at the Model FA and at our RIA, SurePath Wealth. Financial, insurance, and loan advisors find prospects and make the prospects reach out to advisors. For financial advisors, prospecting is essential to attracting new clients and scaling a practice. Interacting with new people in new places will allow you to throw out your «net» and link up with new prospects who are currently in the market for financial advising. Only the following types of retirement plans are insured in this ownership category. 2 Records of the Office of the Executive Secretary. Mobile phone: +32 460 766 704. 2 Records of the Division of Research and Strategic Planning. Coaching, support and training courses offered by our Student Career Services to improve your employability and communication skills. Check out what is going on and is new at Bank of Washington. Please dive in for the 5 financial advisor prospecting ideas that we will be using in 2020. Despite the all too common feeling that you’re ‘narrowing the playing field’ by choosing a niche you aren’t. Provides the option to select multiple states from the drop down menu.

Explore Topics

For example, if you have an interest bearing checking account and a CD at the same insured bank, and both accounts are in your name only, the two accounts are added together and the total is insured up to $250,000. If a couple has a joint interest bearing checking account and a joint savings account at the same insured bank, each co owner’s shares of the two accounts are added together and insured up to $250,000, providing up to $500,000 in coverage for the couple’s joint accounts. Who do you trust in all this noise. Deposits insured by the FDIC include those held in checking and savings accounts, money market deposit accounts and certificates of deposit CDs. Could you be successful in a particular niche. Crowley,Chairman of the Board of Directors, 1934 45. More than one third of banks failed in the years before the FDIC’s creation, and bank runs were common. These insurance limits include principal and accrued interest. This allows you to spend a period of up to twelve months in the Netherlands to find employment. Bad or poor quality prospects lack one or the other, or both. But don’t push someone else’s client to leave their existing FA: That typically backfires. Familiarize yourself with the labor market and meet potential employers by participating in several career events, which are organized every year in collaboration with the study associations. Join our newsletter to get useful tips and valuable resources delivered to your inbox monthly.

Enhanced Content Search Current Hierarchy

«If you’re not growing, you’re dying, especially if the advisor has an aging book. It seems that JavaScript is not working in your browser. Sets forth borrowing guidelines the BIF must follow when borrowing from its members. The Federal Deposit Insurance Corporation FDIC is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures credit unions. Privacy Terms of Use Sitemap. Interest on Lawyers Trust Accounts IOLTA’s are separately insured up to $250,000. A bank in group 1A pays the lowest premium while a 3C bank pays the highest. The FDIC does not insure stocks, bonds, annuities, insurance policies, securities or mutual funds. It seems that JavaScript is not working in your browser. Bank deposit products are offered by Associated Bank, National Association. He’s always thinking of ways to solve problems and puzzles. 2 Records of the Division of Research and Strategic Planning. Examples may include, business owner, professors, executives, entrepreneurs, or surgeons, to name a few. The FDIC is a United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. Third party sites may have different Privacy and Security policies than TD Bank US Holding Company. Financial system by insuring deposits in banks and thrift institutions for at least $250,000; by identifying, monitoring and addressing risks to the deposit insurance funds; and by limiting the effect on the economy and the financial system when a bank or thrift institution fails. The BIF insures deposits in commercial banks and savings banks up to a maximum of $100,000 per account. The participation rate for FY 2009 was 0. 1 Records of the Legal Division. Prospects don’t miraculously find the advisors. The FDIC’s Electronic Deposit Insurance Estimator can help you determine if you have adequate deposit insurance for your accounts. Such information is provided as a convenience to you, and Wells Fargo makes no warranties or representations as to its accuracy and bears no liability for your use of this information.

Why Do We Need Deposit Insurance?

The FDIC does not insure money invested in stocks, bonds, mutual funds, life insurance policies, annuities, municipal securities, and money market funds, even if these investments were bought from an insured bank. MissionMediaRecognitionAdvisory CouncilPartnershipsContact Us. The FDIC is an independent federal agency that was created in 1933 to protect bank depositors whose banks had failed and now also helps maintain sound conditions in the U. Deposits in different categories of ownership at one bank can be separately insured. It’s always a good idea to consult a tax or financial advisor for specific information on how certain laws apply to your situation and about your individual financial situation. The Independent Review is thoroughly researched, peer reviewed, and based on scholarship of the highest caliber. The Federal Deposit Insurance Corporation FDIC is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures credit unions. Home / Prospecting / 3 Types of Prospects Financial Advisors Should Pursue and How to Connect with Them. The hardest part of using social media is discovering what gains traction and brings in an audience. Connecticut law, however, allows the organization of an uninsured bank that does not accept retail deposits. Neither TD Bank US Holding Company, nor its subsidiaries or affiliates, is responsible for the content of the third party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites. At Roosevelt’s immediate right and left were Senator Carter Glass of Virginia and Representative Henry Steagall of Alabama, two of the most prominent figures in the bill’s development. It will be our pleasure to assist you. Did you get a chance to read my previous mail. Familiarize yourself with the labor market and meet potential employers by participating in several career events, which are organized every year in collaboration with the study associations. You may have questions about your money and how it is insured by the FDIC Federal Deposit Insurance Corporation. «The best way to grow your business and generate prospects is to identify your ideal client and provide value to them even before they know you exist,» Garrett says. The Federal Deposit Insurance Corporation FDIC is an independent agency of the United States government that protects against the loss of insured deposits if an FDIC insured bank or savings association fails. The FDIC also examines and supervises certain financial institutions for safety and soundness, performs certain consumer protection functions, and manages receiverships of failed banks. All states also require federal deposit insurance for newly chartered banks that accept retail deposits. Shaun Goolcharan, an advisor with Waterloo, Ont. Financial Analysts are highly desirable in the current market, as businesses focus on what costs they can manage more effectively to drive future growth. Financial system by insuring deposits in banks and thrift institutions for at least $250,000; by identifying, monitoring and addressing risks to the deposit insurance funds; and by limiting the effect on the economy and the financial system when a bank or thrift institution fails.

Enhanced Content Published Edition

He’s also currently learning how to play guitar and piano. Standard FDIC Deposit Insurance Coverage Limits. By: Frank DePino March 23, 2021. Investment products and services are offered through Wells Fargo Advisors. This chart should identify who the financial advisor considers to be top clients, as well as map out some basic facts about them, such as demographic information, education, interests or goals. American Bank’s FDIC Certificate Number is 34422. RSSD ID is a unique identifier assigned to institutions by the Federal Reserve Board FRB. Third party sites may have different Privacy and Security policies than TD Bank US Holding Company. FDIC insurance extends only to deposit products and does not cover securities or other non deposit products in an IRA brokerage account or a self directed defined contribution plan. The Consumer Financial Protection Act prohibits deceptive acts and practices, including deceptive representations involving the name or logo of the FDIC or deposit insurance, by covered firms. Textual Records: Letters and memorandums of Leo T.